Interesting saturday early morning bike ride with COOs and Strategy heads of five budding organisations. They are on the verge of breaking into the big league fighting competition that they chose to avoid so far. Having spent nearly a decade to grow from a startup / revival of an age old defunct organisation - to mid market size - to now, having to confront the big boys, as their size and customer segment now, no longer allows them the luxury of separating themselves as either new kids on the block or as niche players.

The moment, the gorgeous valley at the edge of the cliff, in the early morning light at Khandala stopped being a distraction, the discussions hovered around the issues that have been giving these 5 guys sleepless nights. The intent to chart a new path in this digital age, one that is different from their competition. The desire not to compete with the usual big guys on their terms or home turf but rather traverse a different path ahead, a path which none has conceptualised or had taken before.

This set me thinking. For an enterprise to create the unconceptualised, to chart the uncharted what does it take w.r.t skills, culture and management practises. My view is an organisation that takes business to employee service delivery seriously are the organisations that are best placed to brace the challenges and meet them at a level that is beyond the ordinary. I believe starting at home, is the best model for an organisation to go digital... provide digital business to employee services. Only one of my four friends saw merit in this line of thought. The reason being, the other four started viewing B2E digital services more in terms of capital expenditure towards ipads and iphones and the associated eco-system to sustain it effectively within the enterprise network. Automating payroll MIS and HR services for presence on smartphones! The discussion went in the predictable direction, with Microsoft Surface and wearable computing devices that are now part of healthcare accessory market getting added to the list! This is a very narrow view of B2E digital services.

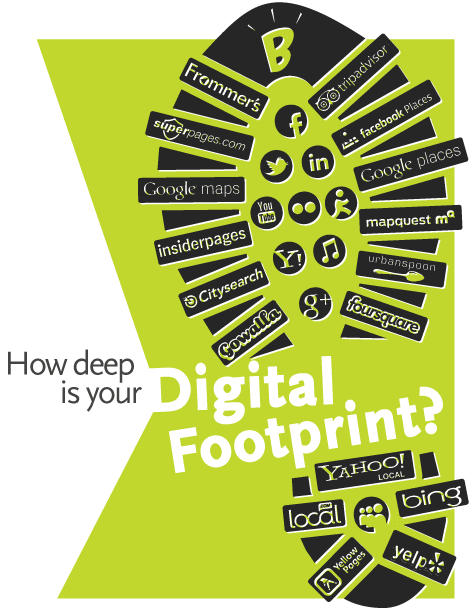

An effective digital enterprise, in my view, is an enterprise that delivers digital experiences as a part of Business2Employee services. Only when employees experience life at work, where the eco-system and workplace experiences get digital, only then they would be able to conceptualise new age digital services for their customers. Some level of experiential learning and a digital experience workplace eco-system, will set the tuning of the thought process at a very different frequency. Employees, during non work hours, weekends and holidays ; as regular consumers undergo some very sophisticated digital experiences just by carrying cell phones and tablets along with them. Location based services predominantly dominate this space. However, location is just one attribute. Digital experience tend to add a significant amount of nuisance value to one's life when they become irrelevant to the task at hand or the time of the day or the event one is experiencing does not resonate with experience being delivered. Context and experience need to be in perfect synch for meaningful digital experience manifestation to add value to one's life. This too, once achieved soon tends to assume a nuisance / irrelevant factor when not laced with personalisation of digital experiences powered by learnings from behaviour analytics of users. To achieve this enterprises need to start stepping into the realm of internet of things, making IoT part of corporate IT & digital strategy.

An effective digital enterprise, in my view, is an enterprise that delivers digital experiences as a part of Business2Employee services. Only when employees experience life at work, where the eco-system and workplace experiences get digital, only then they would be able to conceptualise new age digital services for their customers. Some level of experiential learning and a digital experience workplace eco-system, will set the tuning of the thought process at a very different frequency. Employees, during non work hours, weekends and holidays ; as regular consumers undergo some very sophisticated digital experiences just by carrying cell phones and tablets along with them. Location based services predominantly dominate this space. However, location is just one attribute. Digital experience tend to add a significant amount of nuisance value to one's life when they become irrelevant to the task at hand or the time of the day or the event one is experiencing does not resonate with experience being delivered. Context and experience need to be in perfect synch for meaningful digital experience manifestation to add value to one's life. This too, once achieved soon tends to assume a nuisance / irrelevant factor when not laced with personalisation of digital experiences powered by learnings from behaviour analytics of users. To achieve this enterprises need to start stepping into the realm of internet of things, making IoT part of corporate IT & digital strategy.

A full profound and effective digital enterprise strategy for business to employee services, should actually not involve capital expenditure on gadgets, gizmos and wearable devices, but rather focus on creating an eco-system that at a very basic level, entertains BYOT not with an view to restrict, but rather fully leverage without impacting either enterprise security or freedom to personal digital lifestyles on personal gadgets. Once this is achieved, a digital enterprise should start delivering context aware services that goes beyond the singular attribute of location.

Creating an eco-system that delivers business to employee digital services is a very significant and defining aspect that forms the foundation of a digital enterprise. To envision, conceptualise and architect these services as context aware, event driven and event triggered digital experiences; will not just dramatically improve productivity, cut costs over and above the existing automation layers, but also pushes the employees to think around similar context aware digital experiences for their customers. Without this layer being built, the entire management push towards being a digital enterprise might just end up being a hollow affair.

_0.jpg)

.jpg)