Enterprise India is going through the most exciting and disruptive phase it have ever seen so far. Having said that, I concede having such strong similar sentiments in the year 2000 , 2003, 2007, 2010 and in 2012 ! I get excited when a radical new piece of technology erupts on the scene, and then get disappointed when adoption takes its own sweet time, and then get all excited and crazy when adoption accelerates to life changing gear!

Walking down the memory lane, digitization meant conversion of physical records to electronic data format and automation of workflows that were simple rule based tasks. That is what we did as CIOs and IT Heads between 1990 -2002. While most of IT India was making money on Y2K projects and dollar arbitrage (which it still does - dollar arbitrage) , a few corporates in India were discovering the excitement of going online with customer service and sales. One of the banks I worked for back in year 2000, my Chairman insisted in withdrawing money for the ATM and seeing that transaction the very next moment on his internet banking transaction query screen, and on pull based sms mobile banking transaction screen. We took 8 days to make it happen for credit cards, and I was told by my boss then, that my employment with the bank now feels justified!

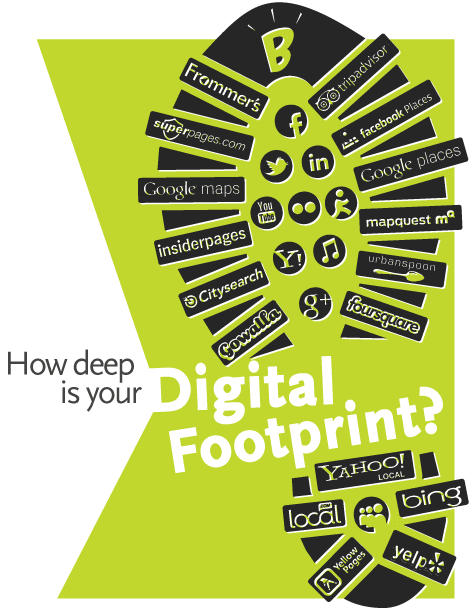

Compare that with about 6 years ago, when you started getting real time alerts, OTP on your smartphone and about 16 months ago that mobile banking apps have been made available with bill payments and internet shopping facilitated with instant merchant payments. Digitization in the yester-years was all about driving efficiency through automated workflows, and in the process enterprises ended up being sole suppliers of technology to customers. Consumerization of IT has put technology directly in the hands of the customers as a lifestyle element, by start-up companies and device manufacturers; with enterprises now playing a catch-up game. Before enterprises could figure out how to participate meaningfully ( some still are) on social networking platforms and in the mobile paradigm, consumer technology has leapfrogged into connected world of internet of things converging rich data and context; leaving behind amazing hidden insights to be discovered through the various digital footprints left by an average consumer, on the grid. Big Data and unearthing hidden intelligent insights has now assumed significant importance for a digital enterprise.

- social networking and general digital utility platforms that users use either directly or indirectly

- technologies that enable one to decipher these footprints for insights

- enterprise IT plumbing that integrates into this world to loop back the learning's and data into their mainstream customer facing technology

- and a whole host of independent apps that serve the customers better than enterprise IT solutions.

When I look at digitization projects with a few enterprises today, mostly financial services world, these are mostly around facilitating easy payments through mobile wallets and mobile devices to leverage the e-commerce boom that is on the surge. Having said that, some of the conversations that I heard during the 1999-2003 era seem to repeat these days - the ones that express anguish about digital space having created a divide between the enterprise and the customer. During the brick and mortar business era, customer relations and hence customer understanding vested with relationship managers, branch tellers, shopping mall attendants and branch managers. Technology was seen as an enabler that would turn this perceived personal asset of front line staff into an enterprise asset. All the CRM systems and online apps have failed to capture this intelligence due to the form filling approach that crept in as a part of this endeavor. Customers were happy to talk about stuff rather than tick check boxes. With consumerization of IT, customers seem less inclined to talk about stuff too. The gap between customer and the enterprise further increases with privacy concerns and the associated laws, as enterprises decide to decipher digital footprints for these insights. In hindsight, the customer touch that existed during brick and mortar era, has now completely vanished and enterprises today seem more far removed from customer insights than before.

Sudip Mazumder

ReplyDeleteDivisional CIO and GM-Business Transformation, KEC International, RPG Group

Thanks Nagaraj for bringing out a topic close to my heart and with a set of new perspectives. I have personally traversed 'customer centricity' journey through CRM, ERP, Analytics, business and process transformation and 'digital' these days. The lingo has possibly not changed over years esp when we talk about '360 deg view of a customer' in 1990s and 2015 or beyond. It is still the same meaning but the enabling technologies changes, demographic and psychographic profiles of customers changed, companies trying achieve that 360 deg perspectives have changed in all 7 S. I agree the 'physical' human touch points reduced to a great extent esp in retail banking, high volume retail etc. but that has been substituted by an emphasis on 'digital' human touch points! One of the major reasons is the demographic and lifestyle changes. Customers have become more virtually social than physically social as less time to focus on one or two things for long hours which might reduce their multitasking driven wider networking! I think for customers and the organisations, it is 'less physical and more digital' yet a win - win relationship.

Ashutosh Tiwari

ReplyDeleteFounding Partner & Director at Cosmos Strategy Consultants

This is largely because enterprises are still trying to tackle digital or in extreme cases embracing digital as a valuable facet. Ideally, an enterprise should use a business model that is best suited to serve chosen customers and deliver higher profitability. That may even be 100% digital or 100% concrete but most enterprises are unable to make those hard choices. I see banks investing simultaneously in more branches, more ATMs, more internet services, more relationship managers for the same demographic .... where's the strategy in that? Hence, lack of empathy might not just be because enterprises are more digital : its also contributed by the fact that they are probably confused.

Ashutosh Tiwari

ReplyDeleteFounding Partner & Director at Cosmos Strategy Consultants

This is largely because enterprises are still trying to tackle digital or in extreme cases embracing digital as a valuable facet. Ideally, an enterprise should use a business model that is best suited to serve chosen customers and deliver higher profitability. That may even be 100% digital or 100% concrete but most enterprises are unable to make those hard choices. I see banks investing simultaneously in more branches, more ATMs, more internet services, more relationship managers for the same demographic .... where's the strategy in that? Hence, lack of empathy might not just be because enterprises are more digital : its also contributed by the fact that they are probably confused.